(Reuters) -Eli Lilly hit $1 trillion in market value on Friday, making it the first drugmaker to enter the exclusive club dominated by tech giants and underscoring its rise as a weight-loss powerhouse.

Here are some reactions to Lilly joining the trillion dollar club:

EVAN SEIGERMAN, ANALYST AT BMO CAPITAL MARKETS

"The current valuation points to investor confidence in the longer-term durability of the company's metabolic health franchise. It also suggests that investors prefer Lilly over Novo in the obesity arms race. Taking a step back, we're also seeing money rotate into the sector as investors may be worried about an AI bubble."

HANK SMITH, DIRECTOR & HEAD OF INVESTMENT STRATEGY AT LILLY SHAREHOLDER HAVERFORD TRUST

"Investors have historically liked secure earnings growth and (Eli Lilly) is the only large cap pharma that has that kind of earnings profile."

(Reporting by Siddhi Mahatole and Shashwat Chauhan in Bengaluru; Editing by Leroy Leo)

LATEST POSTS

- 1

Vote In favor of Your Favored Kind Of Tea05.06.2024

Vote In favor of Your Favored Kind Of Tea05.06.2024 - 2

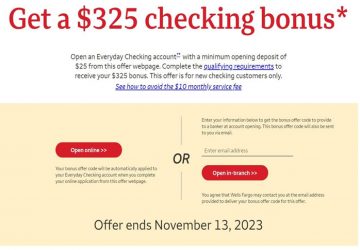

Figure out How to Score Huge with Open Record Rewards18.10.2023

Figure out How to Score Huge with Open Record Rewards18.10.2023 - 3

Jury says Johnson & Johnson owes $40 million to 2 cancer patients who used talcum powders13.12.2025

Jury says Johnson & Johnson owes $40 million to 2 cancer patients who used talcum powders13.12.2025 - 4

Civil rights leader Jesse Jackson hospitalized, family requests prayers12.11.2025

Civil rights leader Jesse Jackson hospitalized, family requests prayers12.11.2025 - 5

San Francisco sues 10 companies that make ultraprocessed food02.12.2025

San Francisco sues 10 companies that make ultraprocessed food02.12.2025

African Forests Have Become a Source of Carbon Emissions

African Forests Have Become a Source of Carbon Emissions New materials, old physics – the science behind how your winter jacket keeps you warm

New materials, old physics – the science behind how your winter jacket keeps you warm Figure out How to Streamline Eco-friendliness in Your Volvo XC40

Figure out How to Streamline Eco-friendliness in Your Volvo XC40 Computerized Moderation: Tracking down Equilibrium in the Advanced Age

Computerized Moderation: Tracking down Equilibrium in the Advanced Age A definitive Manual for Internet Mastering and Expertise Improvement

A definitive Manual for Internet Mastering and Expertise Improvement Vote in favor of the Top Vegetable for Senior

Vote in favor of the Top Vegetable for Senior JFK's granddaughter reveals terminal cancer diagnosis, criticizes cousin RFK Jr.

JFK's granddaughter reveals terminal cancer diagnosis, criticizes cousin RFK Jr. Savvy Watches: Which One Is Appropriate for You?

Savvy Watches: Which One Is Appropriate for You? Help Your Business with Master Web based Promoting Arrangements

Help Your Business with Master Web based Promoting Arrangements